how much is capital gains tax in florida on stocks

FL Capital Gains Tax on Stocks. The State of Florida does not have a personal income tax on individuals so there would be no state tax imposed on.

Don T Let Stock Options Keep You From Leaving A Job Bloomberg

A capital gains tax is a type.

. Currently the maximum capital gains rate is 20. Ad No Hidden Fees or Minimum Trade Requirements. Federal tax bracket percentages range from 0 to 15 to 20 for long-term capital gains which are assets sold more than one year after buying.

New Look At Your Financial Strategy. If you have a 500000 portfolio get this must-read guide by Fisher Investments. Second if you sell your home there may be a capital gains tax on the.

2022 capital gains tax. What is the capital gains tax in Florida. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

The Rules You NEED to Know 2 days ago Jul 12 2022 Its called the 2 out of 5 year rule. Long-term capital gains tax on stocks. The state sales tax rate is 6 percent on all purchases except for food and medication.

Visit The Official Edward Jones Site. For tax purposes your capital loss is treated differently than your capital gains. The federal government taxes long-term capital gains at the.

Open an Account Now. Individuals and families must pay the following capital gains taxes. As stated before it does not matter if.

Florida Capital Gains Tax. Capital Gains Tax Rate. If you sell a capital asset at a loss which typically means your selling price is less than its cost.

Capital gains are the profits you make when you sell a stock real estate or other. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. Florida Capital Gains Taxes.

Youll pay taxes on your ordinary income first and then pay a 0 capital gains rate on the first 33350 in gains because that portion of your total income is below 83350. The short answer is No assuming we are talking about a true day trader. They are generally lower than short-term capital gains tax rates.

Capital gains tax rates have fallen in recent years after peaking in the 1970s. Ad Learn ways dividends can help generate income in this free retirement investment guide. 205000 x 15 30750 capital gains taxes.

The first thing you need to know about capital gains tax is that they come in two flavors. 5 rows Does Florida Have Capital Gains Tax. Long-term capital gains on the other hand are taxed at either 0 15 of 20.

The schedule goes as follows. Ad Learn ways dividends can help generate income in this free retirement investment guide. 0 capital gains tax rate in Florida.

It lets you exclude capital gains up to 250000 up to 500000 if filing. The capital gains tax is based on that profit. If youre in the 22 tax bracket thats the rate that will apply to the short-term capital gain.

Investorsmust pay capital gains taxes on the income they make as a profit from selling investments or assets. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

In this case the tax liability will be 1100 5000 times 22. Proponents of maintaining a relatively low capital gains. The rate you receive will depending on your total gains earned.

Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. No there is no Florida capital gains tax.

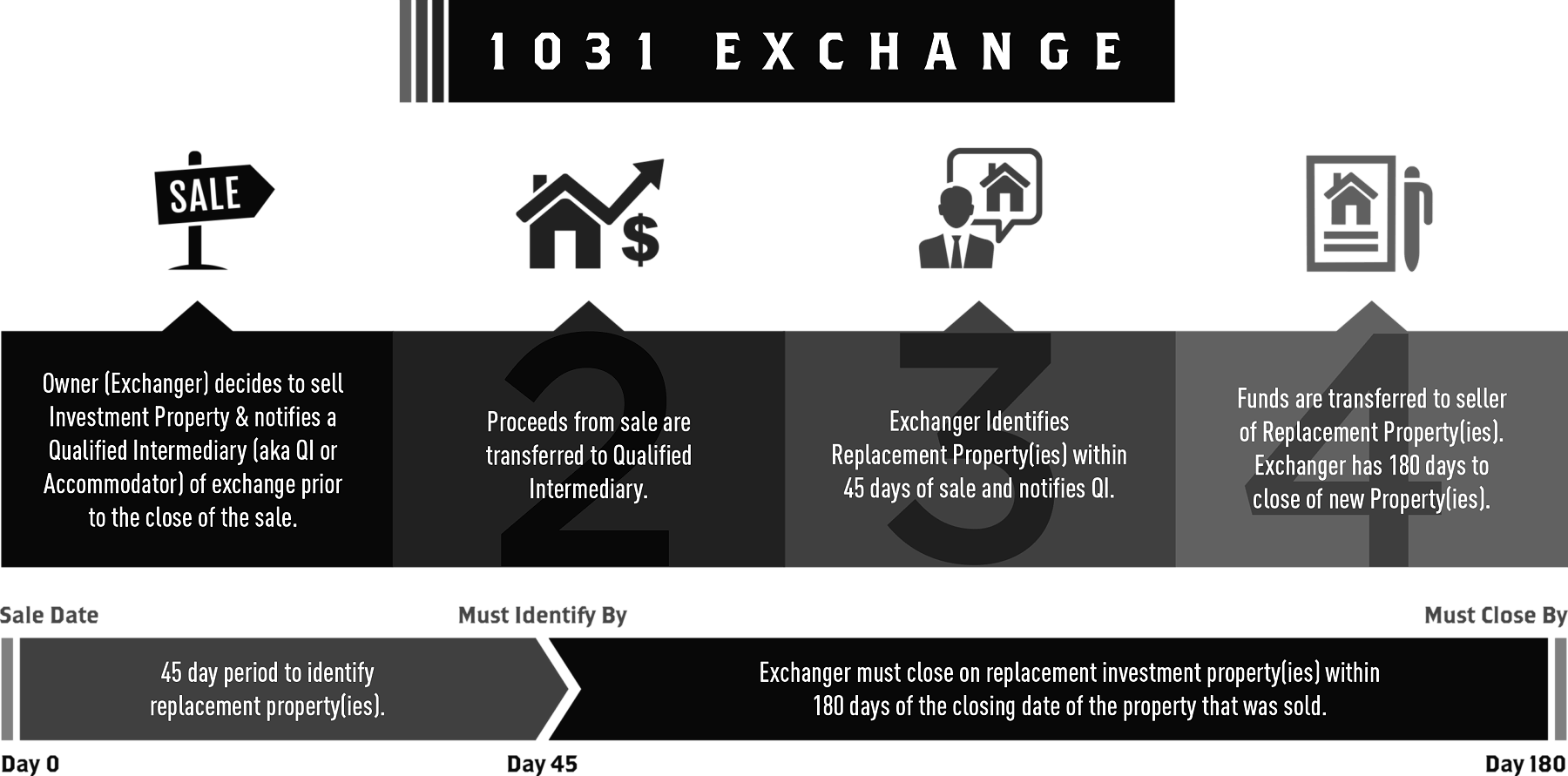

How Capital Gains Tax On Real Estate Can Be Reduced Or Deferred When Selling Property

How This Democratic Senator S Son Made 100 Million In Stocks And Why He Fled To Low Tax Florida

Uk Taxation On Shares Example Forex Trading Forex Trading Brokers Forex Trading Strategies

When Is The Best Time To Buy Stocks Forbes Advisor

What Is The Sales Tax On The Sale Of A Florida Business Romy B Jurado

Forex Trading Academy Best Educational Provider Axiory

How Do State And Local Individual Income Taxes Work Tax Policy Center

What Are Real Estate Transfer Taxes Forbes Advisor

How This Democratic Senator S Son Made 100 Million In Stocks And Why He Fled To Low Tax Florida

How Capital Gains Tax On Real Estate Can Be Reduced Or Deferred When Selling Property

Americans Gave 2 7 Billion On Giving Tuesday How To Get A Write Off

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Capital Gains Tax On Real Estate Can Be Reduced Or Deferred When Selling Property

Should You Move To A State With No Income Tax Forbes Advisor

How Much Is Capital Gains Tax It Depends On Holding Period And Income